The global pandemic that we have experienced over the last two years has left its mark on almost all aspects of our public and private lives. Not the least of which can be observed in the employer/employee relationship. Countless news articles have covered many different aspects of this topic: from furloughs and mass layoffs, to how employers have protected (or failed to protect) their workforce from the virus, to more mundane topics like how home office is managed. Needless to say, the datasets for the America’s Best Employers projects provide a great perspective to observe shifts in employee satisfaction as the pandemic has unfolded.

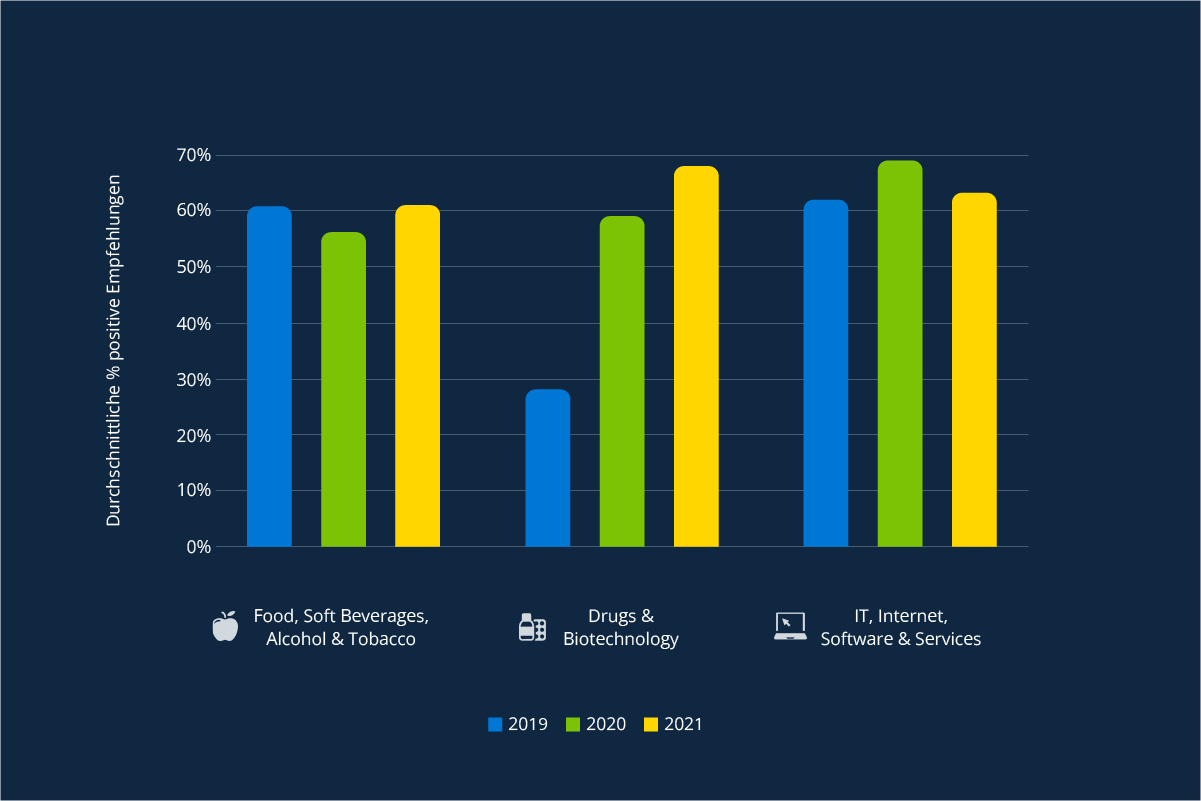

One aspect captured by these surveys is how companies are perceived by the public. The data can be aggregated on an industry level in order to observe possible macro trends that society is dealing with. We did just that, and then we compared data on public perception (in terms of the average percent of positive recommendations the companies within an industry received) that was gathered before the pandemic (2019) to data that was collected during the pandemic (2020 and 2021) . Certainly, at this level of aggregation there are many factors at play and several complex interactions (i.e., other factors besides issues related to the pandemic may have also contributed to the public perception of companies). However, Covid-19 was, and still is, such a dominant topic in our society it stands to reason that many of the trends we observe have something to do with it. When we look across the 25 different industries captured in this dataset, we see three distinct kinds of responses to the pandemic.

The first and most striking case is that of the “Food, Soft Beverages, Alcohol & Tobacco” industry. Here, we observed a dramatic drop in the average public perception in 2020 (see Figure 1). This can most likely be attributed to the negative press surrounding meat processing facilities, which in the early stages of the pandemic were seen to be hotspots for the virus. Interestingly, the perception of companies within this industry has recovered over the course of the pandemic, with the companies involved working hard to address the problems within their industry. Our 2021 dataset shows that the industry has regained its pre-pandemic level of perception (see Figure 1).

A second case that demonstrates a very different response to the pandemic is that of the “Drugs & Biotechnology” sector. Here we observed very little change at the start of the pandemic- the difference between 2019 and 2020 is not significant. However, as BioNTech/Pfizer, Moderna, Johnson & Johnson and others began to solve the vaccination problem, the public perception of the industry took a large step forward and gained nearly 9% by November of 2021 after a successful year of the vaccination campaign.

Finally, we observed a third interesting response in the “IT, Internet, Software & Services” industry. The average perception increased significantly at the start of the pandemic in 2020, as everyone was more or less forced to rely on the technology provided by this industry to a higher degree than they ever had before. This industry played a critical role in helping to buffer the effects of the pandemic, allowing people to connect from home (for work, school, or private reasons) despite various forms of lockdown. Just like with the Drugs & Biotech industry, the public seems to appreciate this contribution, and it stands to reason that these companies incur goodwill and the perception that they would make a good employer. When the shock of the pandemic wore off in 2021, the average score declined somewhat. However, the change is not statistically significant, and this may, to some extent, be attributable to the “techlash” – a backlash against some of this industries’ biggest players, which has its genesis well before the pandemic.

As you can see, the pandemic has certainly had an effect on how companies are perceived by the public. But not all industries were affected in the same way. For some, it seems to have been a temporary setback. For others, it has even precipitated goodwill and overall better evaluations. In any case, it certainly appears that (in a little under 2 years) companies have adapted to life with Covid-19.

Figure 1. These three industries showcase three different reactions to the pandemic: In the first case, an enormous drop in perception in 2020 followed by a recovery in 2021 when the pandemic situation settled. In the second case, a significant appreciation in the perception toward the end of the pandemic. In the last case, a quick improvement in perception that did not return to the previous level in the later stages of the pandemic.